An index fund is a group of stocks (or other investments) designed to reflect the performance of a specific market index, such as the S&P 500 index. Market indices consist of companies or securities that represent a segment of the financial market. Many large indices provide insight into the overall health of the economy.

Investing in index funds is straightforward. First, you need to set an investment goal. If you’re aiming for long-term growth, especially for retirement, index funds may be a good choice. After defining your goal, research different index funds by considering factors such as company size, geography, business sector, asset type, and market opportunities. Once you choose an index, examine costs like investment minimums and expense ratios.

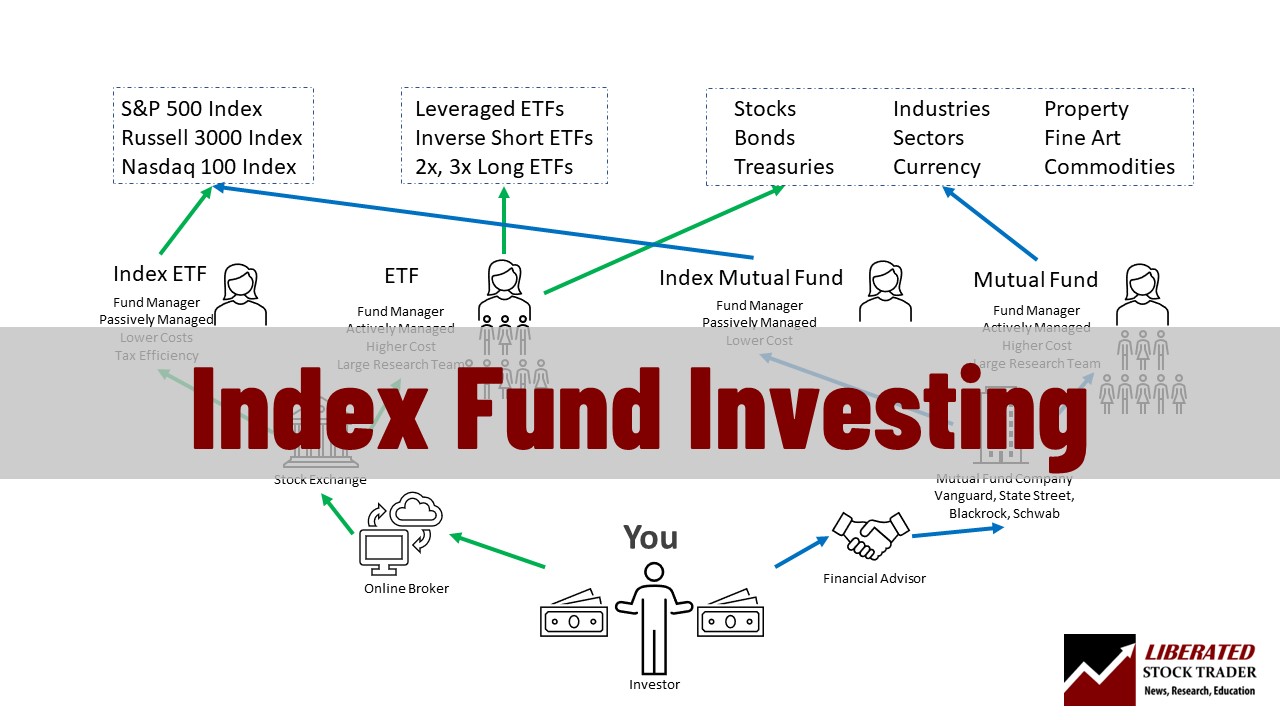

Next, decide where to buy the fund, either directly from a mutual fund company or through a brokerage. When purchasing, consider factors such as the selection of funds, convenience, trading costs, and the availability of commission-free options. Afterward, keep an eye on your investments to ensure they perform as expected and make adjustments as needed.

The best index funds usually come with low costs and solid returns. Some recommended funds include Fidelity Zero Large Cap Index for the S&P 500, Invesco Nasdaq 100 ETF for the Nasdaq-100, and Fidelity U.S. Bond Index Fund for bond markets.

Index funds are passive investments that tend to outperform actively managed funds. In 2024, only a small percentage of actively managed U.S. stock funds beat the S&P 500, and those that did showed minimal outperformance. This is why many investors prefer index funds for long-term growth.

A well-diversified portfolio often includes a mix of stocks and bonds. Index funds simplify this process by offering diversified exposure within a single fund. For example, a basic portfolio might include 85% stocks and 15% bonds, which can be built with just two index funds: an S&P 500 index fund and a bond index fund. This approach provides balanced growth and risk management over time.