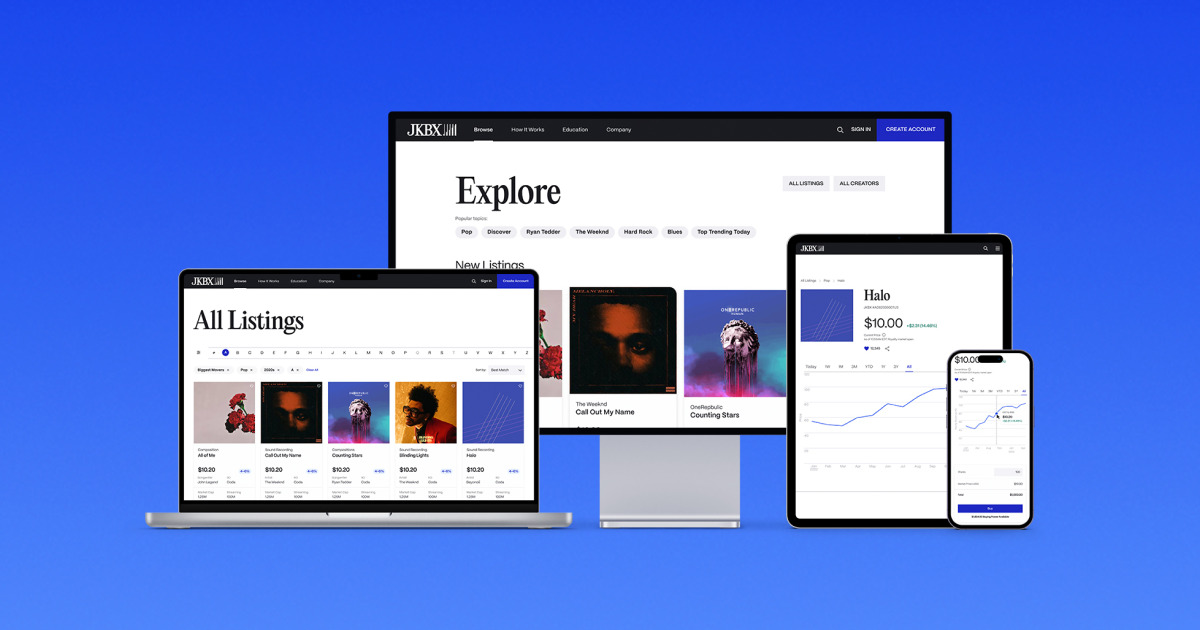

JKBX has recently announced that it has received approval from the US Securities and Exchange Commission (SEC) for its assets, allowing investors, including retail investors, to legally purchase shares in hit royalty streams through JKBX.com as of this week. Previously, users could only reserve these shares while awaiting SEC qualification. Starting March 6, users can purchase royalty stakes in hits from various superstar songwriters and artists such as Beyoncé, Ryan Tedder, Timbaland, the Jonas Brothers, and more.

Currently, purchasers cannot sell their shares on the platform, but JKBX plans to introduce this feature later in 2024. The company was co-founded by Sam Hendel and John Chapman of Dundee Partners, along with Scott Cohen, former Chief Innovation Officer of Warner Music Group, who now serves as JKBX’s CEO.

Scott Cohen emphasized the company’s commitment to regulatory compliance and expressed excitement about making music rights a top alternative asset. JKBX’s platform is open to international investors complying with applicable securities regulations but is currently optimized for US-based individuals. Listings on JKBX.com are categorized alphabetically, by price per share, market cap, decade, and genre.

For example, shares in the composition of Beyoncé’s “Halo” are priced at $14.51 per share, while shares in the master recording of Major Lazer’s “Lean On” are priced at $24.47 per share. These listings provide details such as market cap, estimated royalty share yield, and revenue averages.

Joining Cohen in celebrating this milestone are influential figures from the music and investment worlds. Grammy-winning artist Ryan Tedder shared his excitement, stating, “JKBX has done the hard work to make this possible in a safe and secure way, and I’m so excited for the fans as they get access to this part of the industry.” Likewise, DJ and Producer Diplo commended JKBX for its approach, noting that the platform’s dedication to listing qualified assets ensures a promising future for music investment.

JKBX allows signed-in users to view streaming metrics from platforms like Spotify and SoundCloud, as well as additional information such as the composition’s International Standard Musical Work Code (ISWC). The company aims to become a transformative force in music and investing, having raised $16 million from investors in January 2023 and securing about $1.7 billion in music rights by February 2023.

JKBX’s affiliate, Jukebox Hits Vol. 1 LLC, works with music rights holders to identify income-generating songs and offer them on the platform. The recently launched Creator Program allows artists and songwriters to receive ongoing payments for their music, even if they’ve sold or no longer own the rights. JKBX will pay a portion of revenue to artists and songwriters who signed up for the program and showcase them on dedicated pages.