For first-time homebuyers, understanding mortgage interest rates is crucial in determining affordability. These rates fluctuate based on economic conditions, inflation, Federal Reserve policies, and housing demand, directly impacting how much buyers can borrow and the long-term cost of homeownership.

Boston-based realtor Rafael Reyes recently shared insights on how these fluctuating rates impact affordability, home buying trends, and potential strategies for new buyers navigating the market.

According to Reyes, mortgage rates are influenced by several factors, including economic conditions, inflation, and Federal Reserve policies. As rates shift, so does a buyer’s purchasing power—making it essential for first-time buyers to understand these trends before making a move.

Interest Rates and Affordability

Reyes explains that when mortgage rates are low, buyers can afford larger loans without increasing their monthly payments. However, when rates rise, the same loan becomes significantly more expensive, forcing buyers to adjust their expectations or budgets.

Historical Trends in Mortgage Rates

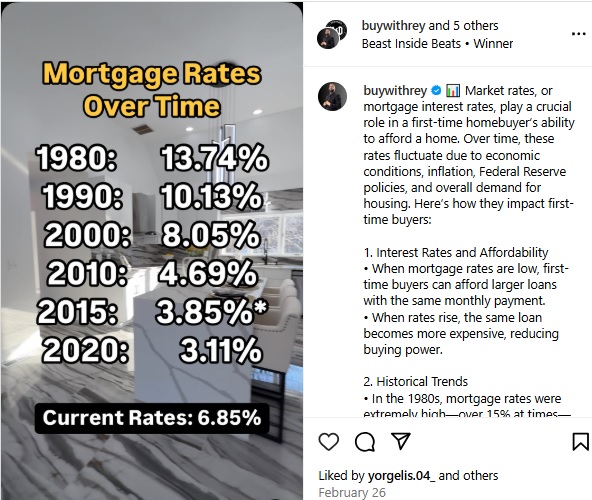

With the current rate at 6.85%, Reyes highlights key moments in mortgage rate history that have shaped the housing market in massachusetts:

- In the 1980s, mortgage rates soared above 15%, making borrowing extremely costly.

- By the 2000s, rates had settled between 5-7%, creating more manageable conditions.

- After the 2008 financial crisis, the Federal Reserve cut rates, bringing them below 4% in many cases.

- During the COVID-19 pandemic, rates dropped to historic lows of 2-3%, fueling a homebuying boom.

- Since 2022, rates have climbed above 6-7% as part of inflation control measures, making mortgages more expensive.

How This Impacts First-Time Buyers

Reyes points out that low mortgage rates tend to encourage homebuying, as they allow buyers to qualify for larger loans. On the other hand, higher rates reduce affordability, often leading buyers to either purchase lower-priced homes or postpone their plans altogether. He also notes that refinancing could be an option in the future if rates decrease after a home purchase.

Strategies for First-Time Buyers

To navigate today’s market, Reyes suggests several strategies for first-time buyers:

- Lock in rates early when searching for a home to avoid potential increases.

- Explore loan programs like FHA loans or first-time buyer assistance programs, which may offer lower interest rates.

- Consider adjustable-rate mortgages (ARMs) if anticipating rate drops in the near future.

- Improve credit scores to qualify for the most competitive rates available.

With mortgage rates remaining a key factor in home affordability, Reyes emphasizes the importance of staying informed and making strategic decisions. While today’s market presents challenges, understanding how interest rates work can help buyers position themselves for success.